The ultra-luxury Six Senses resort in Porto Heli, Greece, is set to open in 2026 following its development. The property will be home to 60 hotel suites and 12 branded residences.

Facilitating the resort development

CBE Capital has succeeded in securing a €95m Greek senior bond loan facility from Piraeus Bank in Athens for its club-deal investment into this new Six Senses hotel and its branded residences.

Through a joint venture, this €150m development is altogether equity-financed by CBE Capital, Golden Land Goutos, Taconic Capital Advisors and Cedar Capital Partners.

Geza Toth-Feher, Managing Partner of CBE Capital, said: “Our Greek debt transaction bucks a trend in the Eurozone, and the US. It shows that high quality transactions, despite difficult market conditions, can still be financed. We are looking forward to working with Piraeus Bank on the financing for the Six Senses Porto Heli.”

Greece’s first Six Senses resort

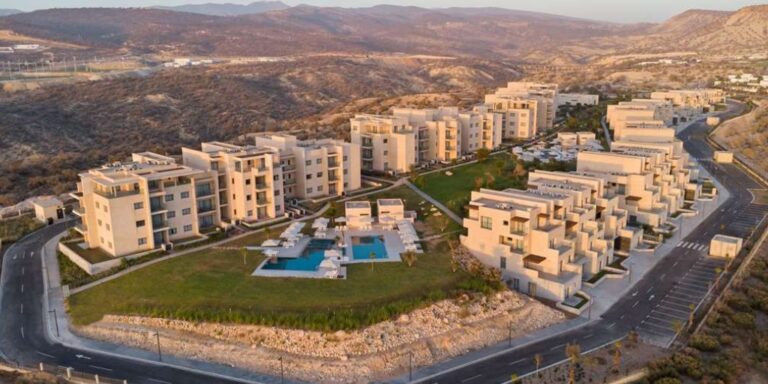

The resort development, which is already being expanded with the purchase of additional land, is set to open in 2026 with a collection of 60 ultra-luxury hotel suites and 12 branded residences.

The property will take shape within two private bays in the municipality of Ermioni on the Greek mainland. From the resort, the islands of Spetses and Hydra will also be within sight.

Commenting on the investment, Mr Theodore Tzouros, Executive General Manager, Chief Corporate & Investment Banking of Piraeus Bank, said: “The financing of this Project is in line with Piraeus Bank’s long-term strategy and commitment to support new investments in the hospitality sector that contribute decisively to Greek economic growth.”

“At Piraeus Bank we are proud to financially support the development of the first “Six Senses” Resort in Greece.”