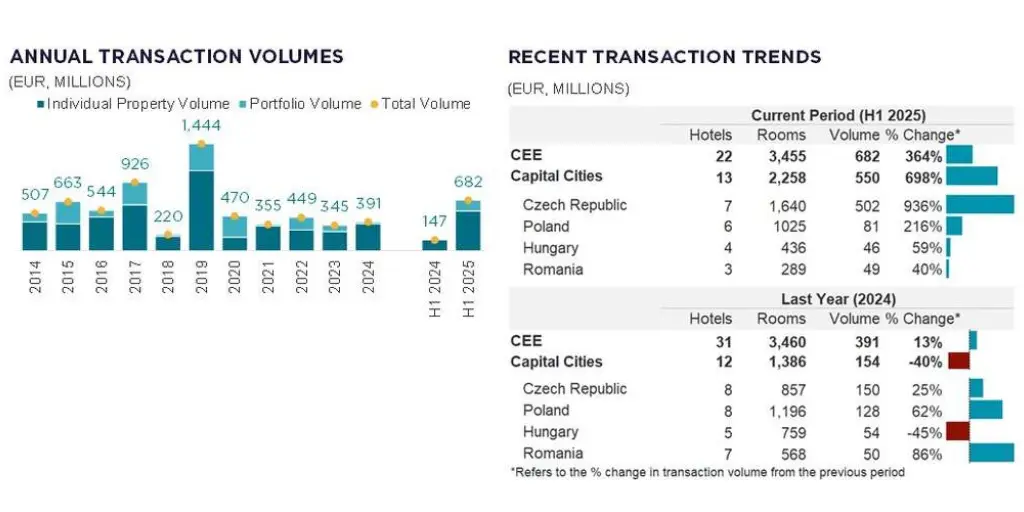

Central European hotel markets enjoyed a strong first half of 2025, with investment volumes reaching their highest levels since 2019.

After a quieter 2024, volumes hit EUR682 million, up a substantial 364% year on year. Activity was greatest in the Czech Republic, followed by Poland and Hungary, report agents Cushman & Wakefield. The busiest segment of the market was upper upscale, followed by luxury hotels.

A busy Prague market

Among significant transactions during the period were several properties in Prague. The Hilton Prague, with 791 rooms, was bought by PPF Real Estate from longstanding owner the Irish Bank Resolution Corporation, at a price reckoned to be close to EUR280 million. PPF also teamed up with Noble Hospitality to acquire the Four Seasons in the city, too.

Also trading was the Mama Shelter in Prague, which was part of a portfolio deal bought by Ares Management. And Aroundtown sold the Penta Hotel in the city for around EUR50 million, after holding the asset since 2019.

Elsewhere, there were four hotels sold in Budapest, adding up to a volume of EUR46 million. And in Gdansk, two deals added up to EUR46 million of assets traded.

With a good number of deals in various stages of progression towards completion, the agents reckon there is positive momentum to enjoy through the second half of the year. As a result, the expectation is that prime yields will tighten.

The region saw 20 properties open in the first half, adding around 1,600 rooms to the market including the launch of the Fairmont Golden Prague, and Corinthia Grand in Bucharest. Warsaw had the greatest volume of new market entrants, with supply up 3.8%, while the comparable figure for Prague was 1.8%.

Operational performance was stronger, with better occupancy encouraging hoteliers to increase their prices. Occupancy averaged 65%, up by 3.4 percentage points, though still below the more than 70% recorded in 2019. Room rates were up an average 6.9%, leading to reported revpar improving by 9.3%. Warsaw was the strongest performing city market, ahead of Sofia and Prague.

One of the strongest pipelines in the region is in Budapest, where many of the international brand groups are building on an existing presence. IHG, for example, is adding a 152 unit Staybridge Suites, while Moxy Budapest Downtown is under construction for Marriott.

Accor’s strong pipeline in CEE

Accor recently opened Jo&Joe Budapest, and is about to launch YOU Budapest as part of its Handwritten Collection. It is watching the conversion of the former Sofitel into SO/Budapest, while the group has also signed a site for 25hours Budapest, which will open in 2030.

In Prague, a Ritz-Carlton luxury hotel is being created from historic houses in the city’s Old Town Square, with the 84 room property due to open in late 2025. The pipeline includes a refurbishment of the Mozart Prague hotel, bringing the 70 room luxury property in line with the brand standards of Accor’s Sofitel brand.