We take a look at how Hilton Worldwide’s development plans have changed month by month since the coronavirus outbreak turned into a pandemic, with reference to exclusive facts and figures from the TOPHOTELPROJECTS construction database.

The Covid19 pandemic has had an enormous effect on the hospitality industry, and the modern-day leaders of hotel companies like Hilton are having to make tough decisions that would have been practically unimaginable to their predecessors.

Founded by Conrad Hilton in 1919 with the purchase of a single hotel in Texas, the business that bears his name grew rapidly over the decades that followed, and now boasts almost a million rooms across 6,200 properties in 118 countries and territories. Today, the Virginia-headquartered company, which is listed on the New York Stock Exchange, is behind an impressive portfolio of 18 brands including Waldorf Astoria, LXR and Conrad in the luxury category; Canopy, Tempo and Motto in the lifestyle segment; and Hilton, Curio Collection, Tapestry Collection and Signia by Hilton in the full-service market.

Yet Hilton’s rapid expansion left it more exposed than most when countries around the world chose to bring in curfews, travel bans and lockdowns during the course of 2020 to cut infection rates.

Hilton’s development pipeline shows signs of slowing

Below, we publish for the first time some key development metrics tracked by our researchers to help paint a picture of how Hilton’s responding to the crisis:

Group |

In progress |

On hold |

Cancelled this month |

Date |

Hilton Worldwide |

748 |

85 |

3 |

04/30/2020 |

Hilton Worldwide |

745 |

91 |

2 |

06/02/2020 |

Hilton Worldwide |

740 |

92 |

3 |

07/02/2020 |

Hilton Worldwide |

726 |

94 |

1 |

08/04/2020 |

Hilton Worldwide |

713 |

99 |

2 |

09/02/2020 |

Hilton Worldwide |

701 |

106 |

5 |

10/02/2020 |

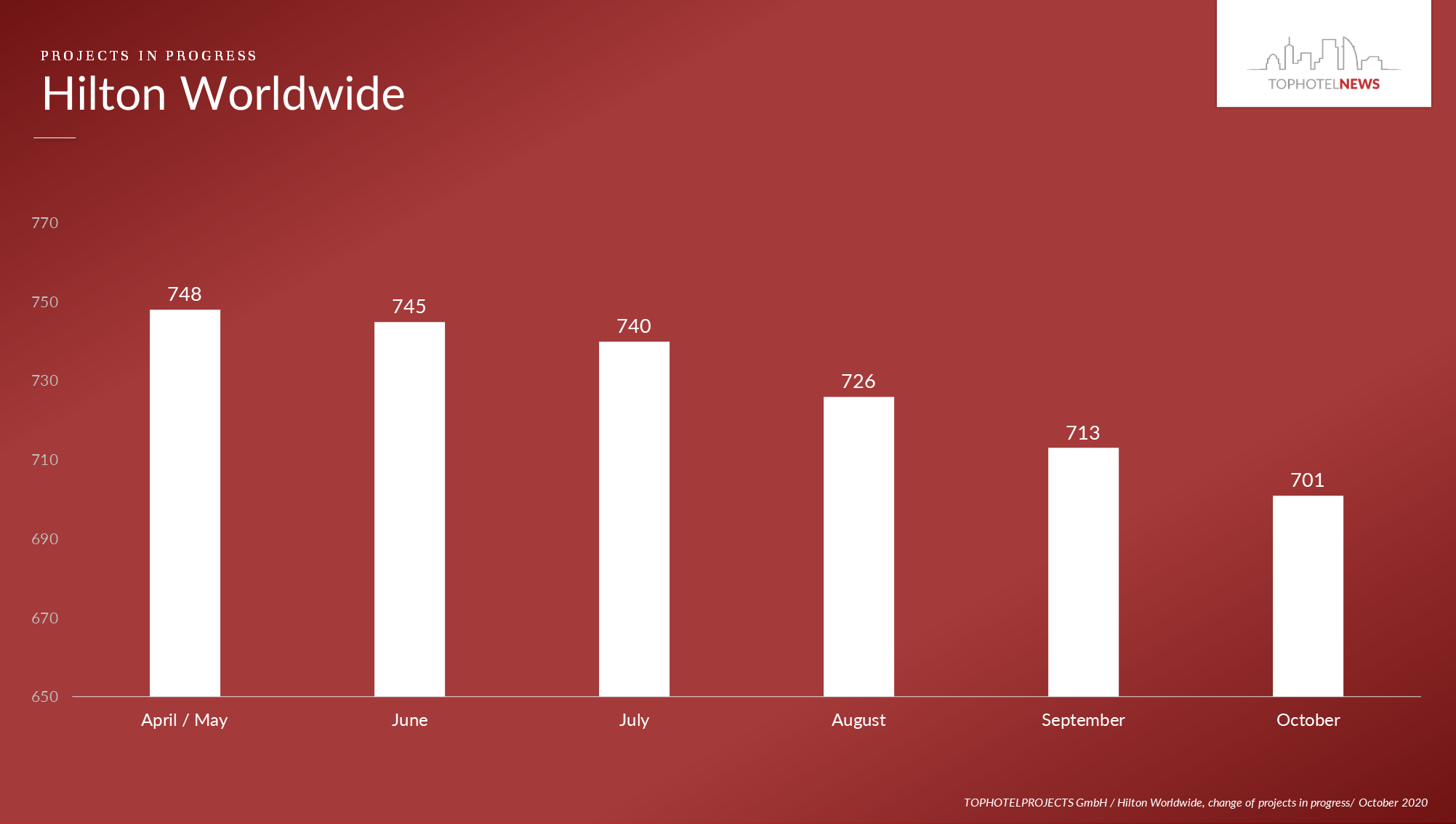

This table, drawing on information from our industry-leading database, shows that Hilton had 748 projects in progress as of 30 April 2020 when Covid19 was beginning to wreak havoc in its domestic market, the US, as well as other key travel destinations across the European and APAC regions. Moreover, the figure has dropped every month since, indicating that the company is not adding new schemes at anything like the same rate as old ones are completing or falling by the wayside, with the total standing at just 701 as of 2 October. This represents a 6% fall in the size of its active development pipeline between the end of April and the start of October – not a devastating drop by any stretch of the imagination, but a worrying sign nonetheless.

The story becomes even more alarming if we turn our attention to the number of schemes that have been mothballed. While there were 85 projects listed as on hold as of 30 April, this figure has since climbed into triple digits, hitting 106 as of 2 October. In percentage terms, the data shows a rise of 25%, meaning that the number of dormant Hilton schemes has increased by a quarter in the last few months alone, which is sure to be a cause for concern for everyone connected to the industry.

However, it’s much harder to draw firm conclusions when we look at the facts around schemes that have been completely abandoned. Our records show that three Hilton projects were cancelled in the month leading up to 30 April, and the figure has fluctuated with no discernable pattern ever since, hitting five in the month ending 2 October. While technically this represents a 66% rise, in reality the numbers involved here are so small that it’s too early to say with confidence what’s happening to the rate at which schemes are being ditched.

In addition, we’d better stress in relation to these figures that it was perfectly normal for overly ambitious projects to fail to make progress even before Covid19 took hold, owing to a myriad of other factors, like escalating costs, insurmountable planning objections or unexpected construction issues; not every scheme that gets mothballed or binned has fallen through because of coronavirus. And doubtless there’ll be some projects currently listed as on hold that do eventually make a comeback and reach completion, as there always have been in previous years.

Hilton takes a cautious approach towards development

The overriding sense we get from this data is that Hilton appears to be reining in its expansion plans somewhat. Nevertheless, we should still point out that the group is progressing the majority of its pipeline regardless of coronavirus, with high-profile schemes like the LXR-branded Susona Bodrum in Turkey and Canopy by Hilton Philadelphia | Center City in the US opening in recent months – and ambitious plans being unveiled to create a luxury resort in Costa Rica.

Hilton has approximately 700 live projects on its books, according to our research, but the trend we’re seeing is that this number is gradually getting whittled down, and the company seems to be hedging its bets as to how quickly the travel market will bounce back from the extraordinary events of 2020. We can only hope as an industry that the world manages to find a cure for Covid19 soon, or at least learns to live alongside it better, which would surely give giants like Hilton the confidence to ramp up investment on new projects again in future.

Click here to read our exclusive Q4 2020 Covid development update series in full: Marriott International | Hilton Worldwide | Accor | IHG | Hyatt Hotels Corporation | Radisson Hotel Group | The Ascott | Wyndham Hotel Group | What the data tells us

Many TOPHOTELNEWS articles draw on exclusive information from the TOPHOTELPROJECTS construction database. This subscription-based product includes details of thousands of hotel projects around the world, along with the key decision-makers behind them. Please note, our data may differ from records held by other organisations. Generally, the database focuses on four- and five-star schemes of significant scale; tracks projects in either the vision, pre-planning, planning, under-construction, pre-opening or newly opened phase; and covers newbuilds, extensions, refurbishments and conversions.

Hilton Worldwide is a leading global hospitality company with a portfolio of brands spanning more than 6,000 properties around the world.