Q4 2020 Covid development update: The Ascott

We consider how coronavirus has affected the development slate of The Ascott, the company behind brands like Préférence, Vertu and Citadines Apart’hotel, with the aid of exclusive data from the TOPHOTELPROJECTS construction database.

There can be no question that the leading lights in hospitality have been put under immense pressure by the pandemic, and like its rivals Ascott has been forced to tread carefully in order to stay relevant in the post-Covid era, which is serving up challenges that its management has simply never had to deal with previously.

The lodging owner-operator, a wholly owned subsidiary of CapitaLand, one of Asia’s largest diversified real estate groups, traces its roots back more than 35 years to the opening of The Ascott Singapore in 1984. It’s been growing swiftly ever since, especially in the serviced-residence sector, and can now boast of having 118,000 rooms in operation or under development across more than 700 properties, with a presence in over 30 countries. Among the Singapore-based company’s brands are the likes of Préférence, Vertu, Ascott The Residence, Citadines Apart’hotel, Citadines Connect, Fox, Harris, lyf, Quest, Somerset and The Crest Collection.

However, the spread of Covid19 has had far-reaching implications for growth-oriented enterprises like Ascott, as countries and territories have rushed to impose lockdowns and travel bans with breathtaking speed, creating a climate of uncertainty that has inevitably fed through into bottom lines at countless properties.

Ascott is stepping up development activity

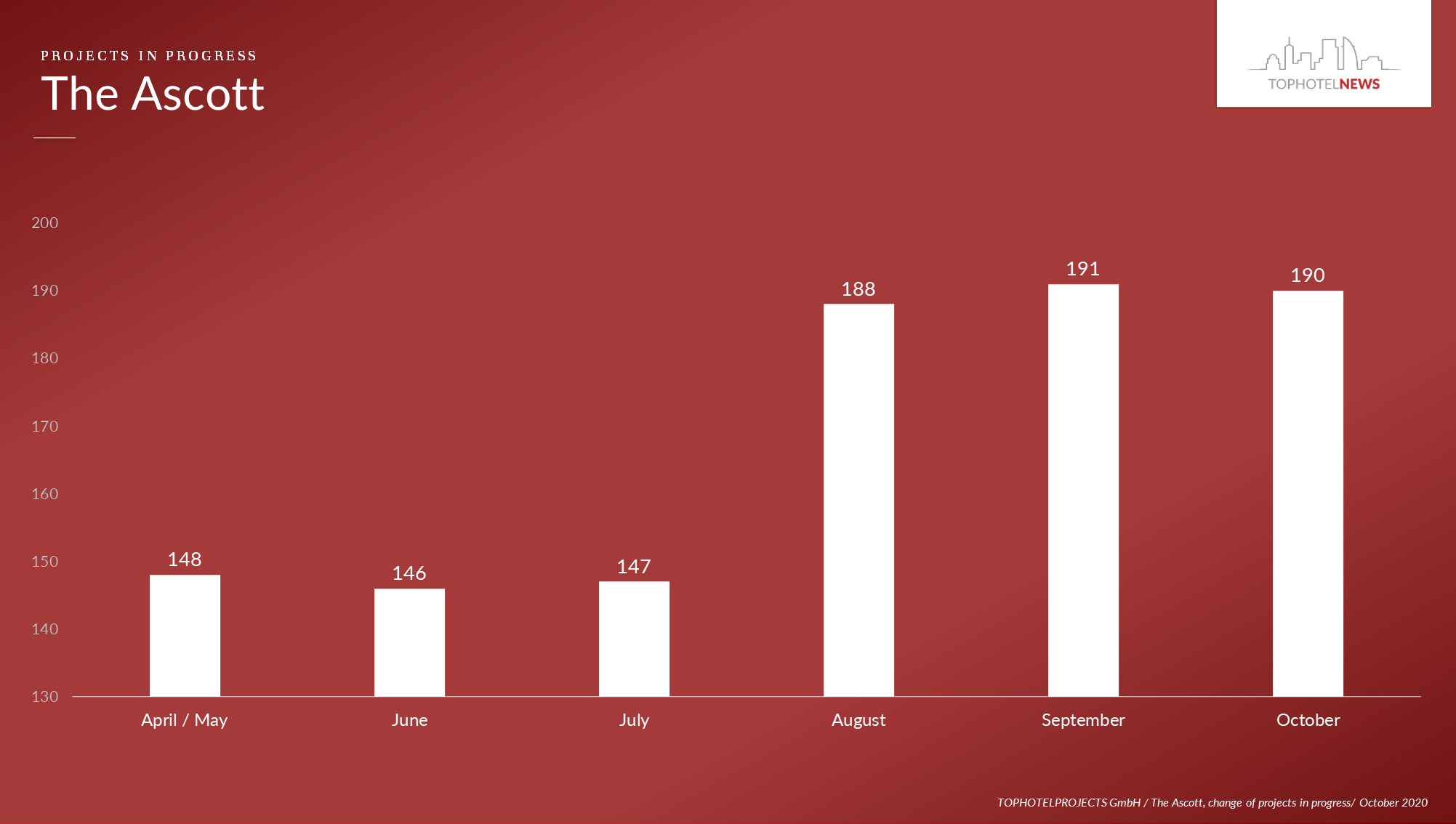

With a view to better understanding how Ascott’s development pipeline has evolved since the virus took hold internationally, our research team has been carefully tracking some of the company’s key stats on a month-by-month basis, and TOPHOTELNEWS can now share the results of this initiative with our readers for the very first time:

Group |

In progress |

On hold |

Cancelled this month |

Date |

The Ascott |

148 | 8 | 0 |

05/13/2020 |

The Ascott |

146 | 9 | 0 |

06/02/2020 |

The Ascott |

147 | 12 | 2 |

07/02/2020 |

The Ascott |

188 | 14 | 1 |

08/04/2020 |

The Ascott |

191 | 14 | 2 |

09/02/2020 |

The Ascott |

190 | 15 | 3 |

10/02/2020 |

The first point that needs highlighting from this table, which provides a snapshot of the information available in our database, is that Ascott’s activity levels have actually grown enormously at a time when many other hotel groups are slowing down their rate of expansion. This is evident in the revelation that Ascott only had 148 live projects on its books as of 13 May 2020, when coronavirus first started wreaking havoc around the world, but that the total had soared to 190 as of 2 October. In percentage terms, it works out as a startling 28% hike in just five months, which perhaps suggests that all the recent talk in the industry about safety-minded travellers switching en masse from hotels to serviced apartments is now feeding through into tangible results on the ground.

Admittedly, the story is complicated somewhat if we turn our attention to how many schemes have been put on ice over the same period. The table indicates that a mere eight Ascott projects were on hold as of 13 May, but that this figure had steadily crept up to 15 as of 2 October, which equates to an alarming jump of 88% in just a few short months. However, the numbers we’re dealing with here are still comparatively small so we should probably refrain from dwelling too much on this, particularly given that they’re nowhere near big enough to affect the overall picture we’re seeing of a business that’s growing at jaw-dropping speed.

We also need to reflect on the rate at which Ascott is abandoning projects altogether. Surprisingly, none of its schemes were cancelled in the month leading up to 13 May, compared to three in the corresponding period up to 2 October. Of course, we’re always concerned to hear about rises in the number of projects that are destined to never be realised – and any failure is tough to take for those businesses involved behind the scenes – but we mustn’t lose sight of the fact that these figures are still tiny in the grand scheme of things.

On a more general point, it’s worth noting that we’ve been tracking development activity across hospitality since 2009, and in that time we’ve seen plenty of ambitious projects fail to progress – perhaps because of funding shortfalls, contractual issues or myriad other reasons – so it’d be inaccurate to blame every misstep we’ve detected in 2020 on coronavirus. Equally, we’ve seen lots of exciting projects suspended for a substantial period of time down the years, only to subsequently be brought in from the cold and successfully taken through to completion when circumstances improved – in other words, a dormant scheme isn’t the same as a failed scheme.

The pandemic isn’t stopping Ascott

If we were to only take one message away from our deep dive into Ascott’s future plans, it’d be this: unlike many big hotel groups, the Singapore-based company is significantly ramping up expansion amid the coronavirus outbreak. Whereas some businesses are adopting a decidedly cautious approach and merely trying to defend the properties they launched when the going was good, Ascott seems to have spotted an opportunity to steal a march on its competitors. Maybe this is reflected in the fact that it’s celebrated a string of new additions to its portfolio recently, including signing six more lyf properties and opening a chic 108-room serviced residence in London.

We’re talking about a company that now has almost 200 active projects on the go, which will hopefully go some way to reassuring those in the hospitality industry who are understandably fearing the worst at present. All the data suggests that the serviced-residence market is faring relatively well in the post-Covid era and, as one of its key proponents, Ascott seems determined to capitalise on this fact by rapidly scaling up its global footprint.

Click here to read our exclusive Q4 2020 Covid development update series in full: Marriott International | Hilton Worldwide | Accor | IHG | Hyatt Hotels Corporation | Radisson Hotel Group | The Ascott | Wyndham Hotel Group | What the data tells us

Many TOPHOTELNEWS articles draw on exclusive information from the TOPHOTELPROJECTS construction database. This subscription-based product includes details of thousands of hotel projects around the world, along with the key decision-makers behind them. Please note, our data may differ from records held by other organisations. Generally, the database focuses on four- and five-star schemes of significant scale; tracks projects in either the vision, pre-planning, planning, under-construction, pre-opening or newly opened phase; and covers newbuilds, extensions, refurbishments and conversions.