The Ascott’s brands are continuing to enter new markets despite coronavirus. (Picture: Booking.com)

In this exclusive TOPHOTELPROJECTS analysis, we look at how Covid19 has affected the expansion plans of The Ascott (Ascott) and Ascott Residence Trust (ART).

The emergence of Covid19 in late 2019 has had enormous implications for the global hospitality market. Countries around the world have introduced strict lockdowns and restrictions on travel to reduce infection rates and ease the burden on their healthcare systems, creating enormous challenges for businesses offering short and long-term travel accommodation.

Ascott, the Singapore-headquartered lodging owner-operator, boasts an extensive property portfolio spanning more than 30 countries across Asia, Australasia, Europe, the Middle East, Africa and North America, presenting it with plenty of problems as coronavirus has swept the globe. Wholly owned by listed giant CapitaLand, one of Asia’s largest diversified real estate groups, Ascott’s brands include Ascott The Residence, The Crest Collection, Somerset Serviced Residence, Quest Apartment Hotels, Citadines Apart’hotel, lyf, Préférence Hotels, Vertu Hotels, Harris Hotels, Citadines Connect, Fox Hotels, Yello Hotels and Pop! Hotels.

Coming up, we take a look at Ascott’s busy project development pipeline. We also see how the share price and response to Covid19 have developed over recent months at ART, the listed hospitality trust whose portfolio comprises 88 properties across 15 countries, mostly operated under the Ascott The Residence, Somerset, Quest and Citadines brands; ART is a stapled group comprising Ascott Real Estate Investment Trust (Ascott Reit) and Ascott Business Trust (Ascott BT). ART is managed by Ascott Residence Trust Management (as manager of Ascott Reit) and Ascott Business Trust Management (as trustee-manager of Ascott BT), both of which are wholly owned subsidiaries of CapitaLand.

Coming up, we take a look at Ascott’s busy project development pipeline. We also see how the share price and response to Covid19 have developed over recent months at ART, the listed hospitality trust whose portfolio comprises 88 properties across 15 countries, mostly operated under the Ascott The Residence, Somerset, Quest and Citadines brands; ART is a stapled group comprising Ascott Real Estate Investment Trust (Ascott Reit) and Ascott Business Trust (Ascott BT). ART is managed by Ascott Residence Trust Management (as manager of Ascott Reit) and Ascott Business Trust Management (as trustee-manager of Ascott BT), both of which are wholly owned subsidiaries of CapitaLand.

Ascott races ahead with development plans

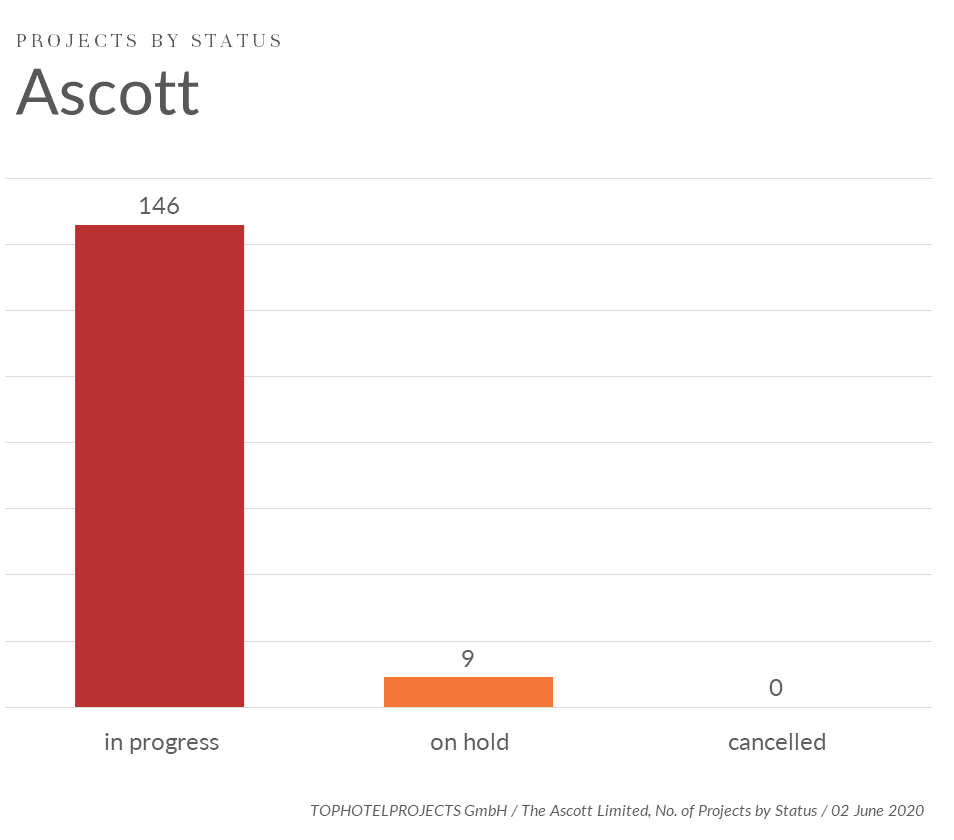

By accessing the TOPHOTELPROJECTS online database, we can see that Ascott has no fewer than 148 projects in progress, with nine more on hold, as of 2 June 2020.

Switching our attention to the brand-by-brand breakdown, it becomes clear that Citadines is Ascott’s most prolific brand with 68 projects, followed by Somerset (43) and Ascott The Residence (27), with the rest trailing some distance behind:

Admittedly, the long-term implications of the Covid19 crisis are not yet clear, and it may well be that Ascott decides to postpone or abandon other projects in future if the situation takes a turn for the worse. Nevertheless, it is reassuring to note that the company still appears to be pressing ahead with realising its development pipeline at the moment.

Extraordinary effect of Covid19 on ART’s share price

Ascott remains steadfastly committed to developing these projects in spite of the fact that investor confidence in the hospitality industry has been severely shaken over recent months, as can be seen by examining the dramatic change in ART’s share price.

Until the second half of February 2020, when coronavirus was still deemed relatively low risk by many in the markets, ART was trading at around 1.35 Singapore dollars (US$0.97) per share. But concerns then mounted rapidly and the share price dropped precipitously over the following month, tumbling to a low of 0.69 Singapore dollars by 23 March.

The situation has steadily improved since then, however, and ART has managed to regain most of the lost ground. As of 9 June, its share price stood at a respectable 1.16 Singapore dollars.

How ART’s response to Covid19 has evolved

Throughout the pandemic, ART has kept investors informed about the impact that Covid19 is having on its operations, painting a revealing picture of how the crisis has developed over time.

Way back on 30 January 2020 when the company released its full-year results, Beh Siew Kim, CEO of the managers of ART, noted: “We are actively monitoring the development of the novel coronavirus situation and have taken the necessary precautionary measures at our properties in accordance with guidelines from the health authorities. These include conducting temperature checks at our properties and intensifying cleaning and disinfecting of our properties.”

In addition, the company pledged to take more precautionary measures where necessary. “The extent of the impact from the novel coronavirus situation is uncertain as it is still evolving,” she added. “Our geographically diversified portfolio with no concentration of earnings from any single market, as well as a mix of stable and growth income streams, are expected to mitigate the impact.”

Hospitality trust steps up coronavirus response

By the time of the company’s 2019 annual report, published on 13 April, the situation had deteriorated markedly. “Since January 2020, concerns over the Covid19 outbreak have affected the global economy and travel industry,” wrote Beh Siew Kim alongside ART chairman Bob Tan Beng Hai in the document. “The global growth outlook for 2020 is expected to be fragile, as the full impact of the outbreak is dependent on how long the situation persists.”

However, there was still cause for optimism about ART’s future prospects, with the duo noting: “As most of our properties are serviced residences mainly catering to corporate or long-staying guests, the long average length of stay helps to support occupancy levels…We remain confident that business and leisure travel will resume when the Covid19 situation eases, and demand for accommodation will recover.”

ART acknowledges challenges but remains optimistic

A similar mix of positives and negatives was evident on 30 April when the company published a document entitled 1Q 2020 Business Updates. On the one hand, investors were told that average occupancy rates had fallen, and 18 properties were temporarily closed due to a government mandate or to optimise resources. But on the other hand, they were informed that the company was benefiting from having stable income sources, supportive lenders and a healthy balance sheet to tide it over through the downturn.

Looking ahead, ART advised that the second quarter of 2020 would “remain challenging”, before adding that the business was still “confident of long-term growth”.

Covid19 has certainly had an enormous impact on ART, in common with countless other hospitality companies. But just like with Ascott, there are early signs that it can look forward to a brighter future after an extraordinarily challenging start to 2020.

The Ascott is a Singapore company that has grown to be one of the leading international serviced residence owner-operators.