(Picture: Insider TV / YouTube)

We delve exclusively into the TOPHOTELPROJECTS construction database to get an insight into how Jin Jiang’s development pipeline may be affected by coronavirus.

Shanghai Jin Jiang Capital Company, or Jin Jiang for short, has been hit hard by the fallout from Covid19.

At the end of 2019, the Shanghai-based hotel company held or managed 8,606 hotels across 66 countries – 85% of these properties were in China, where of course the novel coronavirus first came to prominence, while 87% were owned by third parties but operated under franchises granted by the group. And it’s further worth pointing out that Jin Jiang’s varied business portfolio spans the full-service hotel, select-service hotel, passenger transportation vehicles and logistics, and travel agency segments; in the hotel space alone, its brands include the likes of Tulip Inn, Campanile, Kyriad and many others.

We shouldn’t forget either that Jin Jiang’s controlling shareholder Jin Jiang International Holdings Company acquired a majority stake in Radisson Hospitality Inc and Radisson Hospitality AB in November 2018.

Here, we take a look at how Jin Jiang’s hotel development pipeline is shaping up amid all the uncertainty caused by the pandemic. We also examine how the company’s share price has evolved throughout 2020, as Covid19 spread rapidly around China and the rest of the world.

Here, we take a look at how Jin Jiang’s hotel development pipeline is shaping up amid all the uncertainty caused by the pandemic. We also examine how the company’s share price has evolved throughout 2020, as Covid19 spread rapidly around China and the rest of the world.

Development plans in numbers

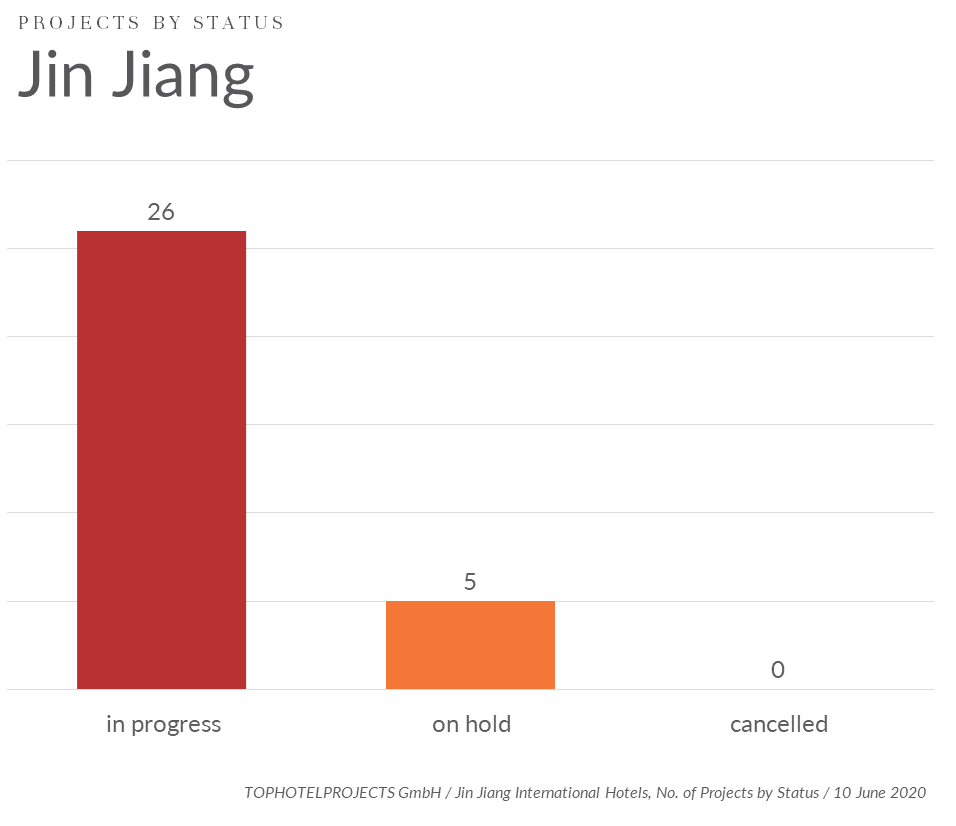

The TOPHOTELPROJECTS construction database may not be able to give us a complete picture of the expansion plans of a global giant like Jin Jiang, but nevertheless it can give us a valuable insight into what’s happening on the ground. It reports there are 26 projects in progress as of 10 June 2020, with a further five developments on hold.

The fastest-growing brand in the database is Hampton by Hilton China with 11 active projects, followed by Tulip Inn (four), Kyriad and 7 Days Premium (both three), Jin Jiang Hotels and Hotel12 (both two) and Maison Albar (one):

Of course, we need to be wary of attributing every stoppage in the hotel development sector to Covid19, since we ought to highlight that not every project managed to get over the line prior to the pandemic either. However, the fact that five projects are on hold is interesting in and of itself – this equates to 16% of all the schemes logged in the database.

Shares respond to an extraordinary few months

A stable share price can help companies plan for the future, so Jin Jiang’s management will no doubt be acutely aware that shares in the business have been rather volatile so far in 2020.

Shares in Jin Jiang, which is listed on the Hong Kong Stock Exchange, were trading at around HK$1.6 (US$0.2) per share at the start of 2020 – they stood at HK$1.61 on 17 January, for example. Yet their value fell sharply to just HK$1.19 per share on 23 March, presumably as investors factored in the enormous impact of the pandemic on the hotel industry.

Since then, the situation has improved somewhat, and the share price had rallied to HK$1.42 by 23 June 2020.

Counting the cost of Covid19

Jin Jiang addressed the topic of Covid19 head on when announcing its final results for the 2019 calendar year on 31 March 2020. “All over the world, efforts are being made to prevent and control the epidemic,” the statement read. “All business sectors have been subjected to rigorous challenges, and the hotel, food and restaurant, passenger transportation and logistics and travel agency segments of the group have been significantly affected.

“During this time, the group has worked vigorously to support the epidemic prevention and control by adopting various measures, such as waiving the ongoing franchise fees in whole or in part, handling the hotels expropriated and temporarily closed, enhancing disinfection and sanitisation of hotels, and by processing the cancellation or rescheduling of customers’ trips, in a diligent effort to fulfil its corporate social responsibility.”

Like everyone in the hospitality sector, Jin Jiang has had to adapt rapidly to reflect the very different world in which we now live. But if countries and cities can manage to get coronavirus under control, particularly in the company’s Chinese heartlands, its management will no doubt be hopeful that the business can attract far more guests in future as consumer confidence gradually recovers.

Jin Jiang International Hotels is one of the leading hotel operators and managers in the PRC.