Q4 2021 Covid development update: Accor [Infographic]

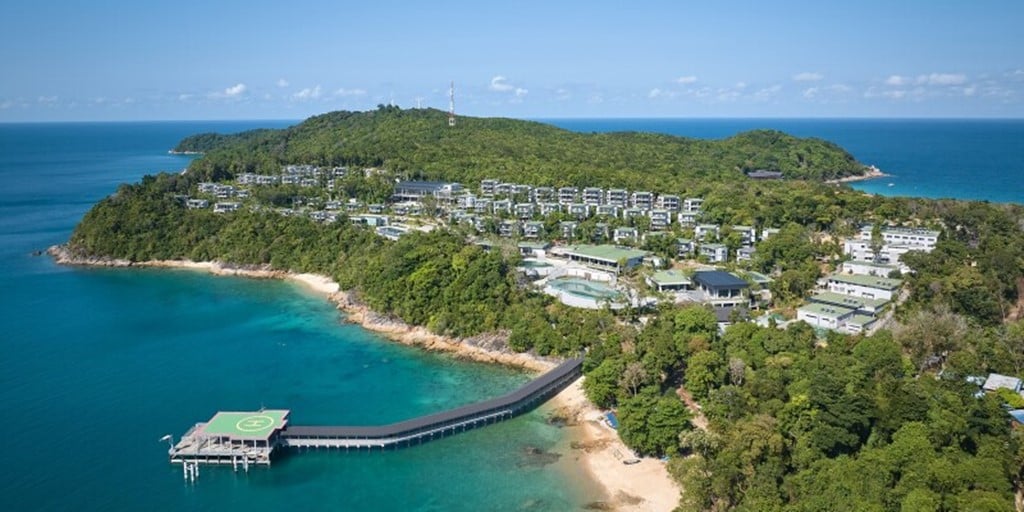

Grand Mercure Khao Lak Bangsak

Our exclusive series continues with a look at how Accor, which is behind brands like Raffles and Pullman, rapidly grew its pipeline early on in the crisis but has since scaled back slightly.

The Covid19 outbreak has been incredibly disruptive for the travel sector, and the top six hotel groups (Marriott International, Hilton Worldwide, Accor, IHG, Hyatt Hotels Corporation and Radisson Hotel Group) have all been hit hard. Today, we’re going to delve into what’s happened to the development slate of French hospitality giant Accor.

This Paris-headquartered listed company has a presence in 110 countries and boasts 5,200 hotels across dozens of brands, including Raffles, Orient Express, Banyan Tree, Fairmont, Sofitel and Rixos in the luxury segment, and Pullman, Swissôtel, Grand Mercure, MGallery, Mantis and Angsana in the premium category. The business also recently completed a landmark joint venture with Ennismore, creating a new lifestyle powerhouse with 87 operating properties under flags like The Hoxton and Gleneagles. But the extraordinary footprint of France’s largest hotel group certainly presented plenty of challenges for management when coronavirus took hold globally in early 2020, leading many governments to temporarily impose curfews, travel bans and lockdowns.

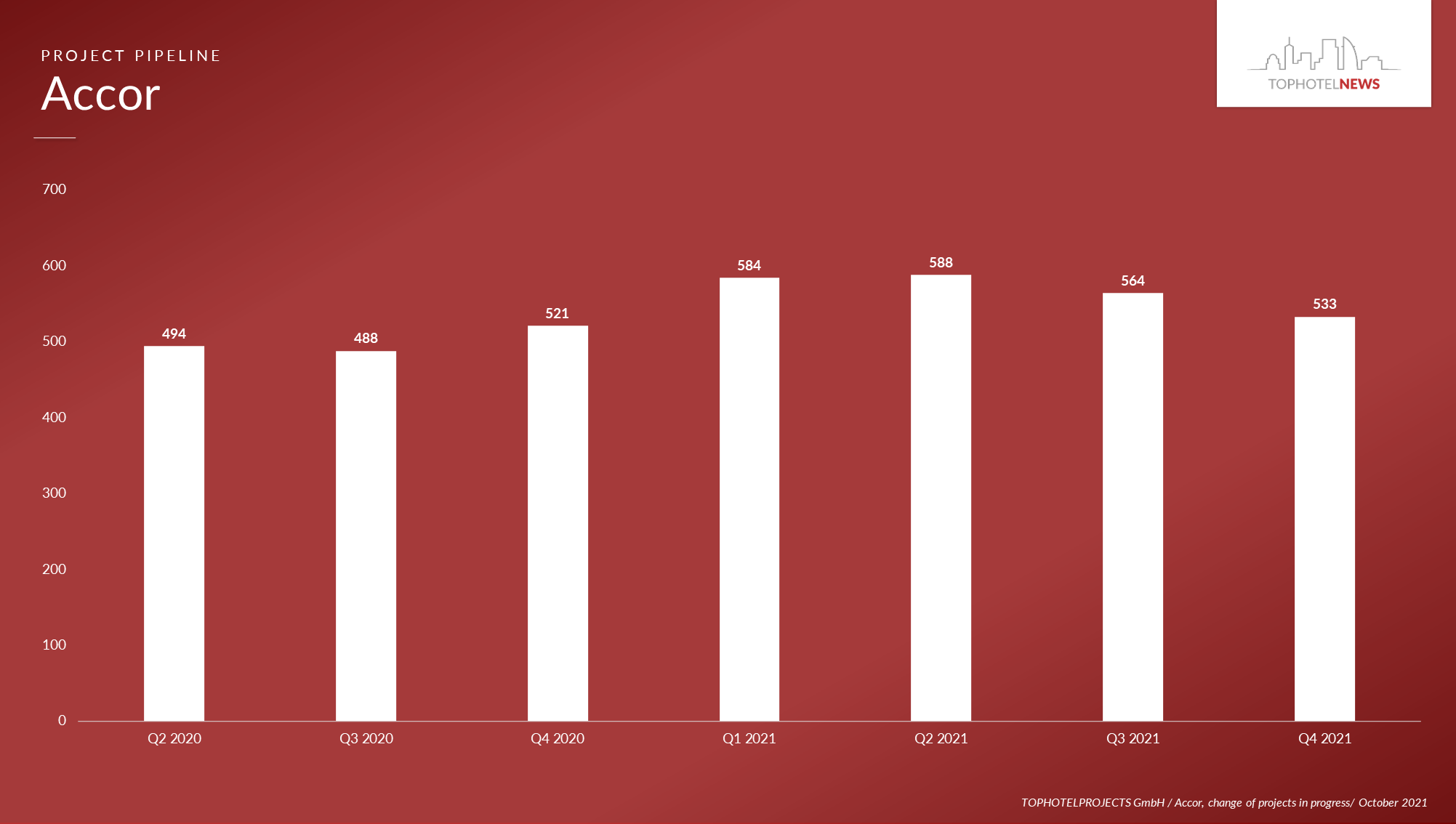

Accor’s development slate peaked in early 2021

By using TOPHOTELPROJECTS construction data logged by our dedicated research team, we get a clear picture of how Accor’s pipeline has fluctuated over the last 18 months:

| Quarter | Date | Hotel projects in progress |

| Q2 2020 | 04/30/2020 | 494 |

| Q3 2020 | 07/02/2020 | 488 |

| Q4 2020 | 10/02/2020 | 521 |

| Q1 2021 | 01/06/2021 | 584 |

| Q2 2021 | 04/13/2021 | 588 |

| Q3 2021 | 07/02/2021 | 564 |

| Q4 2021 | 10/04/2021 | 533 |

Accor had just under 500 hotel projects (494) in progress as of 13 May 2020, at a time when Covid19 was raging across Europe and North America, and many analysts expected activity to fall sharply as the pandemic rendered lots of soon-to-be-built and part-built schemes unviable and discouraged new signings. Yet the reality was quite different, with the total number of projects in fact rising fairly steadily up until 13 April 2021 (588). Since then, however, the situation has reversed and the group’s pipeline has steadily shrunk to 533 as of 4 October 2021.

Nevertheless – and some might say counterintuitively – the fact remains that Accor’s still bringing forward 8% more schemes in Q4 2021 than it was when Covid19 concerns were at their peak in Q2 2020. This is the biggest 18-month increase we’ve detected across the top six hotel groups – although the true picture’s somewhat complicated by the revelation that activity levels are now dipping again. It may simply be that last year the company had lots of nearly finished projects that management decided to complete rather than scrap, or that its count was artificially inflated by securing a raft of low-risk conversion opportunities from apprehensive owners instead of pursuing a few high-risk projects with huge capital expenditure requirements, but it’s hard to know for certain at this stage.

A closer look at Accor’s development slate

What does all this movement in Accor’s pipeline look like on the ground? Well, the company has managed to realise a diverse array of high-profile schemes over the last few months – proof that it’s capable of delivering in even the most challenging economic conditions . Among the most striking are Raffles Udaipur, a spectacular property set on a 21-acre private island that represents the luxury brand’s first outpost in India; Morocco’s Fairmont Taghazout Bay, showcasing the design expertise of HKS and Moroccan architect Abdessamad Achrai; and Grand Mercure Khao Lak Bangsak, a Thai village-inspired resort featuring its very own picturesque canal.

And despite the slight slowdown in the rate at which new projects are being added to its development slate, the group’s nevertheless continuing to restock when the opportunity arises. The TOPHOTELPROJECTS construction database, for instance, is currently tracking a variety of newly announced schemes of the calibre of Artista San Antonio, referencing the Texan city’s Spanish colonial roots with a strong Latin American flavour; and Mantis Bahrain Hawar Island Hotel & Resort, fusing luxury travel and ecotourism in one of the Middle East’s biodiversity hotspots.

Accor is expanding despite Covid19

Our data indicates that Accor has maintained a fairly bullish attitude towards development amid the pandemic, growing the number of live schemes on its books in the midst of a crisis unprecedented in modern history. However, while activity levels climbed steadily up to the beginning of Q2 2021, they’ve actually tailed off slightly in recent months as ambitious schemes by the likes of Raffles, Fairmont and Grand Mercure have completed.

We’ll be closely following what happens to Accor’s pipeline in the months and years ahead, and it’ll be fascinating to see if this recent drop-off is a sign of things to come, or merely a temporary blip in what’s otherwise been a period of sustained investment in the future.

Click here to read our exclusive Q4 2021 Covid development update series in full: Marriott International | Hilton Worldwide | Accor | IHG | Hyatt Hotels Corporation | Radisson Hotel Group | Marriott and Hilton slumps hit pipeline

Many TOPHOTELNEWS articles draw on exclusive information from the TOPHOTELPROJECTS construction database. This subscription-based product includes details of thousands of hotel projects around the world, along with the key decision-makers behind them. Please note, our data may differ from records held by other organisations. Generally, the database focuses on four- and five-star schemes of significant scale; tracks projects in either the vision, pre-planning, planning, under-construction, pre-opening or newly opened phase; and covers newbuilds, extensions, refurbishments and conversions.