Covid19 hotel development analysis: Radisson Hotel Group [Infographic]

Radisson still has a healthy hotel development pipeline despite the pandemic.

We leverage exclusive data from the TOPHOTELPROJECTS database to analyse the impact of Covid19 on Radisson and its hotel pipeline.

With the hospitality industry finally seeing green shoots of recovery in key markets around the world, we take a look at how some of the largest names in the hotel sector have been impacted by the coronavirus outbreak.

Today we examine Covid19’s effects on Radisson, its project pipeline and its future prospects.

Hotel project pipeline review

Radisson Hotel Group is the go-to-market name for Radisson Hospitality Inc together with its majority-owned subsidiary Radisson Hospitality AB. In recent years, Radisson has been steadily growing its portfolio both in established and developing markets. This has led to the group taking a leading position in many regions and attracting a broad range of travellers with its diverse offering.

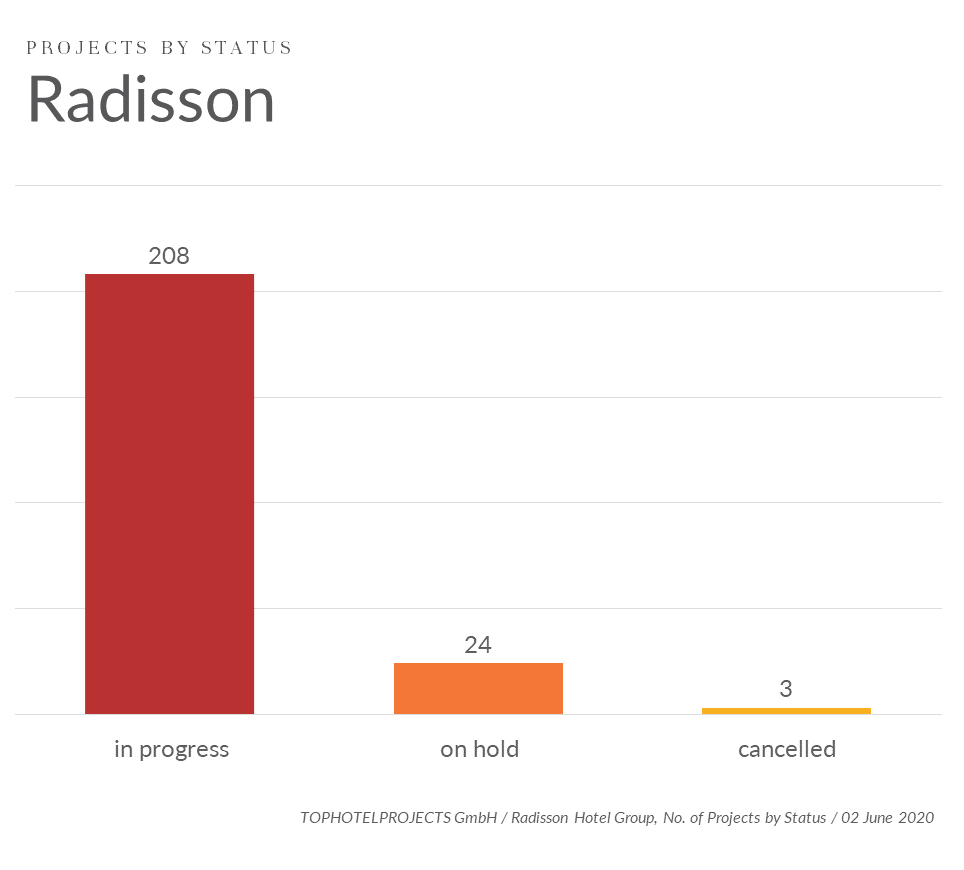

Currently, Radisson has 208 hotels in its pipeline and shows no signs of significantly slowing down despite the crisis.

Of course, Radisson has felt the effects of the Covid19 crisis like the rest of the hospitality industry, which perhaps might help explain why 24 of its projects are on hold and three more have been cancelled as of 2 June 2020.

Of course, Radisson has felt the effects of the Covid19 crisis like the rest of the hospitality industry, which perhaps might help explain why 24 of its projects are on hold and three more have been cancelled as of 2 June 2020.

Radisson Hospitality AB under the microscope

When Radisson Hospitality AB president and CEO Federico J González spoke about the outlook for the year ahead in his commentary for its 2019 year-end report, published in February 2020, he struck an optimistic note, saying that he expected all of the company’s five-year plan initiatives to be completed as expected. “Concerning the potential hit from the coronavirus, so far the negative impact is considered negligible due to the limited impact of Chinese and Asian travellers on our client base,” he added.

Since then, however, Covid19 has spread rapidly around the world, with hospitality companies in particular being hit hard by a wave of lockdowns in major markets.

The financial impact of Covid19 on Radisson Hospitality AB

Radisson Hospitality AB delisted from NASDAQ Stockholm in 2019, meaning share prices can no longer be used as an indicator of the company’s health and performance, but we can still take a look at its mitigation measures and cash liquidity.

In its 2019 year-end report, the business noted that “the outbreak of Covid19 in EMEA in Q1 2020 has had a significant impact on Radisson’s performance as from March 2020”. In response, management adopted a number of measures including but not limited to temporary layoffs of personnel, rent negotiations and deferrals, application for governmental subsidies and loans, and postponement of certain capex investments, which will undoubtedly have helped it make substantial savings.

Additionally, the company noted that it had cash and cash equivalents of €239.6 million.

This is not to say that the business has been immune to the fallout from the pandemic though, as the report makes clear. “The effects of Covid19 in 2020 have significantly impaired available liquidity,” it said. “Through the group’s and the shareholders’ direct actions, liquidity and equity for the next 12 months are secured and the group’s continued operations are not threatened. The board of directors and management closely follow developments to continue to take the necessary measures.”

What next for Radisson?

It remains to be seen precisely how Radisson will adapt to the so-called ‘new normal’ of operating amid a pandemic. Nevertheless, the group’s strong development pipeline suggests that its leaders remain confident there will still be plenty of demand for new hotels in the coming months and years.